What Does ChatGPT Think?

This October, I will celebrate my 12th year as an Accredited Senior Appraiser (ASA) in Business Valuation with the American Society of Appraisers (also ASA). ASA members meet every year for an International Conference to discuss current topics and to share knowledge and best practices. I attended the most recent Conference in Portland, OR. A presentation entitled “The AI Revolution – Why it Matters to Appraisers & Application Strategies” by Greg Endicott of Strategic Value Group, LLC summarized a BVResources Survey on AI as follows:

1. Adoption: About 48% of business valuation (BV) firms are using AI, primarily for researching economic or industry conditions.

2. Popular Tools: ChatGPT is the most popular AI tool, used by70%of respondents. Other tools include Copilot, Bard (now Gemini), and Grammarly.

3. Concerns: 52%of firms are not using AI due to trust issues, data confidentiality concerns, and fear of AI “hallucinations.”

These takeaways were based on a survey of Business Valuation firms, not the general public. So, if about half of the BV firms surveyed are using AI, what can someone looking for a valuation get from asking a simple question into an AI engine?

a

a

Here is the free answer a business owner gets from ChatGPT:

The “rule of thumb” in valuing a business as a multiple of EBITDA generally follows broad guidelines, depending on the business’s size, industry, and growth potential. Here’s a quick overview of common multiples based on these factors:

Rule of Thumb by Business Type/Size

1. Small Businesses (less than $10 million in revenue):

o 3x – 5x EBITDA: Small businesses with modest revenue and growth potential usually command lower multiples due to higher perceived risks and less scalability.

2. Medium-sized businesses ($10 million – $100 million in revenue):

o 5x – 7x EBITDA: These companies tend to attract higher multiples as they are more established, often with stronger growth prospects and greater market presence.

3. Large Businesses (over $100 million in revenue):

o 7x – 10x EBITDA or more: Larger, well-established companies with stable cash flows, competitive advantages, and strong management teams often get higher multiples. These businesses are usually more attractive to institutional investors or private equity firms.

Rule of Thumb by Industry

1. Low-Growth or Capital-Intensive Industries:

o 3x – 5x EBITDA: Industries like manufacturing, construction, and retail, which often have higher fixed costs and lower growth potential, typically have lower multiples.

2. Moderate-Growth Industries:

o 5x – 7x EBITDA: Businesses in sectors like healthcare services, logistics, or consumer products generally attract mid-range multiples due to their stable but moderate growth prospects.

3. High-Growth Industries:

o 8x – 12x EBITDA or more: Technology, software, and biotech companies with high growth potential and scalable business models can see much higher multiples, sometimes exceeding 12x EBITDA, especially if they have recurring revenue models.

Simplified Rule of Thumb:

For most small and mid-sized businesses in stable industries, a 4x to 6x EBITDA multiple is a common rule of thumb.

So, does this artificial intelligence have it right? Sort of. However, the above ranges and rule of thumb come with the implied caveat, “it depends…”

1. It depends on the industry;

2. It depends on the size of the revenue;

3. It depends on the amount of EBITDA;

4. It depends on the future growth of the Company and

5. It depends on the risk in achieving this growth.

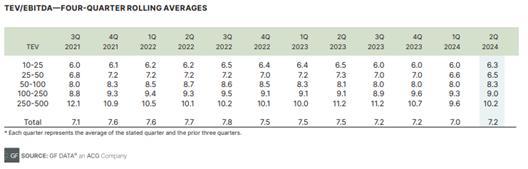

Historical Data in Support of ChatGPT Multiples

In testing these ChatGPT multiples, we looked at a database of actual transactions of lower middle market deals over the past few years. Below is a summary of rolling average EBITDA multiples for real deals up from the 4th quarter of 2020 through the 2nd Quarter of 2024. The data is compiled by GF Data, which collects and provides data primarily from private equity (PE) sponsors and other deal professionals involved in middle-market mergers and acquisitions (M&A). The data covers a range of metrics, including transaction multiples, leverage levels, and other deal terms, and is generally vetted and aggregated to protect the confidentiality of individual transactions while providing a robust data set for market analysis.

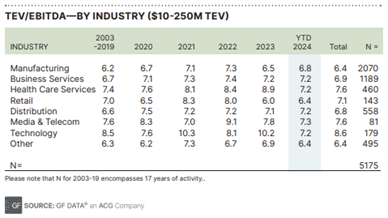

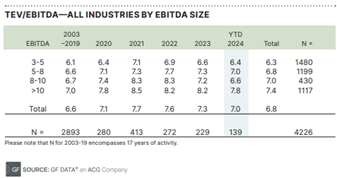

As databases go, this one is pretty good. It has a statistically significant dataset populated and used by dealmakers. I like to use these multiples often to value businesses with significant EBITDA of at least $2 million or more. Here are the average multiples for all industries based on transaction enterprise value (TEV), by industry and by EBITDA size.

Based on the above charts, GF Data does a good job supporting ChatGPT’s “rule of thumb” estimates for medium to large companies of 5x to 12x. However, because GF Data’s multiples are averages, they don’t specify outlier deals with lower and higher multiples than the 6.4x to 8.6x multiple ranges by industry.

For smaller deals, we have used the Business Reference Guide as a strong “pricing guide” as our first iteration of value when discussing with a potential client a rough estimate of the value of their small businesses.

Conclusion

My conclusion is that ChatGPT does of job of cobbling together a starting point for a discussion on the value of your business, but it doesn’t do the job of a business valuation appraiser or M&A advisor. Use ChatGPT like you use Zillow.com to value your house. The multiples above will give you a very rough estimate of the value of your business. However, this first iteration will not suffice for compliance (litigation as well as gift, estate, or income tax) or strategic (exit planning, assessment for sale, or merger) purposes.

Exit Strategies values control and minority ownership interests of private businesses for tax, financial reporting, and strategic purposes. If you’d like help in this regard or have any related questions, you can reach Joe Orlando, ASA, at 503-925-5510 or jorlando@exitstrategiesgroup.com.

Exit Strategies values control and minority ownership interests of private businesses for tax, financial reporting, and strategic purposes. If you’d like help in this regard or have any related questions, you can reach Joe Orlando, ASA, at 503-925-5510 or jorlando@exitstrategiesgroup.com.