Expect M&A to Recover in 2024

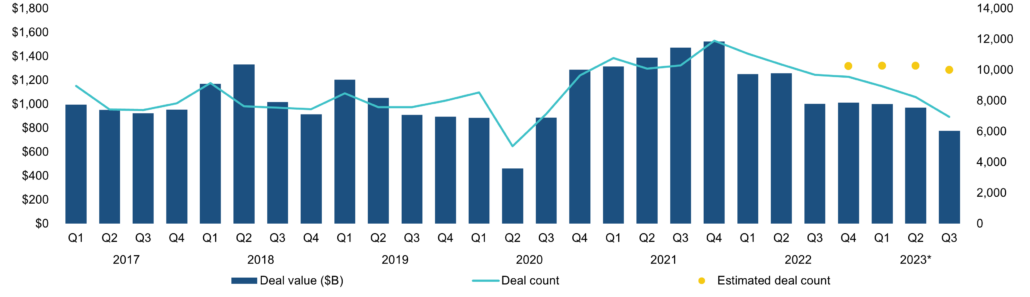

Global M&A deal value nearly reached a 10-year low in Q3 2023 (Q2 2020 excepted). Deal count and total deal values both declined, as shown in this graph produced by Pitchbook. And these declines were evident across almost all most industry sectors and among all types of acquirers and sellers.

However, several factors are pointing to a recovery in M&A activity in 2024. The global total of $1.4 trillion in unspent PE dry powder is just 9.7% shy of its all-time high, and an even larger cash pile is on the books of corporations, positioned for new deals. There is also pressure building on the valuation front. Public markets are looking expensive again relative to private markets. Lower private-market valuations may spur rich public strategic buyers to scoop up private targets. Also, a halt in interest rate hikes or reversal would put less upward pressure on borrowing costs, which have been a major headwind for dealmaking this year.

If you’re contemplating a sale, we would be happy to discuss current market conditions and whether the time is right to achieve your goals.

Al Statz is the founder and President of Exit Strategies Group, Inc. For further information on this subject or to discuss an M&A, exit planning or business valuation question or need, Email Al or call him at 707-781-8580.