Request a Strategy Call and we will get in touch with you

Will appear on Seller pages – RECENT SELLER ARTICLES

Sales of Small Businesses on the Upswing

According to a recent Inc. Magazine article, “Let’s Make a Deal“, sales of small businesses in Q3-2013 jumped 42% from the same quarter in 2012. Inc. quotes Curtis Krocker, group manager of BizBuySell.com, “After four years of depressed selling and buying activity, the markets are coming back.”

According to a recent Inc. Magazine article, “Let’s Make a Deal“, sales of small businesses in Q3-2013 jumped 42% from the same quarter in 2012. Inc. quotes Curtis Krocker, group manager of BizBuySell.com, “After four years of depressed selling and buying activity, the markets are coming back.”

Why? Motivated sellers and available financing. Many older baby boomer business owners are ready to sell their business and retire. Having held off selling during and immediately after the recession, there is pent-up demand to sell now. Furthermore, banks are willing to lend for small business sales again. During the recession, the Small Business Administration and participating banks had all but turned off the spigot for small business loans. The economy has changed…and so have the financing sources.

So…now what?

If you are a business owner considering selling your business – have your business objectively evaluated by a qualified expert. Know how much your business is worth, so that you can make an informed decision about a) selling now or b) continuing to grow the business and selling later.

If you are an individual thinking about buying a business, pull together a personal balance sheet — know how much of a down payment you can afford. Then…start visiting business-for-sale websites like BizBuySell.com, to get your creative juices flowing, thinking about what kind of business you might like to buy. And…call your local business broker. They may be selling the perfect business for you. And even if they don’t…they can match you with future business opportunities or even do a retained acquisition search for you.

Strike while the iron is hot!

J. Roy Martinez is a Certified Valuation Analyst (CVA) and member of the California Association Business Brokers. He can be reached at jroymartinez@exitstrategiesgroup.com or 707-778-2040

What Sells Businesses? Quality Information.

- Company History

- Ownership, Owner’s objectives

- Products and Services

- Customer Base

- Suppliers

- Industry

- Competition

- Employees & Independent Contractors

- Management & Key Individuals

- Operations

- Tangible Assets

- Intangible Assets

- Facilities and Lease Terms

- Systems & Technology

- Sales & Marketing

- Relationships

- Strengths, Weaknesses, Opportunities and Threats

- Financial history, normalized*

- Financial forecast, when appropriate

Importance of a Proper Valuation before Offering a Business for Sale

Want a successful merger or acquisitions? Put an M&A advisor on your board.

Companies planning a merger or acquisition would do well to have an investment banker (M&A advisor) on their board of directors.

A new study from the University of Iowa found that firms with an investment banker on their boards of directors pursue mergers and acquisitions more often. Moreover, those firms perform better after the acquisition has been completed than firms that don’t have investment bankers on their boards.

Thinking of Selling Your Business? Don’t Let Built-In Gains Tax Surprise You.

I was recently asked by “Chester” to help him sell the $10 million service company he founded 24 years ago. Chester, who is 65 years old, has had some health concerns and wants to travel the world with his wife Margie. Two of his competitors have been acquired in the past 3 years by strategic buyers. His business is doing well and he thinks the time is right to sell. In Chester’s industry, almost all acquisitions are asset (versus stock) purchases.

When Chester told me that he converted from a C- to an S-Corporation 6 or 7 years ago, we asked his CPA to estimate his tax burden if he sells now. It turns out Chester faces a large Built-In Gain (BIG) tax bite, which was a surprise to him. In my experience as an M&A advisor, Chester is not alone. Many S-Corporation owners are unaware that such a monster is lurking in the shadows.

What is a Built-In Gain?

C-Corporation owners face a “double tax”, where gains on a sale of assets are taxed at the corporate level and subsequent dividends are taxed at the shareholder level, whereas in an S-Corp there is no federal corporate level tax. Congress’ enactment of built-in gains tax was intended to prevent C-Corp owners from making an S election just before selling their companies’ assets to avoid corporate-level taxes.

When a C-Corp converts to an S-Corp, a “built-in gain” is determined, based on the Fair Market Value of the corporation’s assets (both tangible and intangible) less the tax basis in the assets on the date of conversion. Essentially, built-in gain is the gain that would have been taxed had the C-Corp sold its assets on the conversion date. Built-in gain should be determined, in the eyes of the IRS, by a business valuation prepared by a qualified independent business appraiser, as of the conversion date.

How much is the tax and how long after C to S conversion does it apply?

Built in gains was codified in 1986 in Internal Revenue Code Section 1374. Per the code, an S-Corporation is subject to a Built-In Gain tax for 10 years from the first day of the year of conversion from C to S. And yes, Built-In Gain tax is commonly called the “BIG Tax”. Who says the IRS doesn’t have a sense of humor!

For Federal purposes, at the corporate level, built-in gains are taxed at 35%. Additionally, a dividend tax at the shareholder level is assessed, and state taxes are assessed at both the corporate and shareholder level.

IRC Section 1374 was amended to reduce the 10-year recognition period to 7 years for asset sales occurring in companies’ 2009 and 2010 tax years, and to 5 years in 2011. The American Taxpayer Relief Act of 2012 extended the temporary 5-year recognition period to 2012 and 2013. By the way, California continues to require a 10-year holding period. Welcome to California; now open your wallet!

Unless Congress acts, if a Company sells in 2014, the original 10-year recognition period will apply. That means there might be a real incentive to close a sale before the end of this year. Otherwise an S corporation owner might want to hold on long enough to outlast the 10-year BIG recognition period. This is the decision Chester made. At 65 years old with declining health, Chester made a gut-wrenching choice that involves real financial risk and adds emotional stress to his next few years in business.

So what should S-Corp owners with a BIG problem do?

- If you own a C-Corp and your expected holding period is 10 years or more, seriously investigate converting to an S-Corp now.

- If you previously converted from a C-Corp to an S-Corp, and you plan to go to market within your BIG window, be sure to have an independent, IRS-compliant business valuation prepared as of the date of conversion. Valuations can be prepared retrospectively.

- If you’re considering selling now, close your deal before the temporary 5-year BIG window reverts to 10 years in 2014. Time is running out if you want to hit this window.

- When an asset sale is reported for tax filing, the selling price is allocated among the various assets sold (AR, inventory, equipment, goodwill, etc.) If you sell next year, one way to reduce (though probably not escape) the BIG tax is to allocate part of the sale price to personal assets, such as personal goodwill. However, personal goodwill is not justifiable in many businesses, and any attempt to allocate price outside the corporation will be closely scrutinized by the IRS, and should be supported by an independent valuation.

Please be sure you understand the tax consequences of a sale of your company, whether you plan to sell this year or several years from now. Exit right, retire well!

Business valuations play an important part in many tax matters, and exit planning for business owners increases their chances of a successful exit. For additional information or for advice on a current need, please do not hesitate to call Al Statz at 707-778-2040 or Email alstatz@exitstrategiesgroup.com.

Do Strategic Buyers Share Synergies with Sellers?

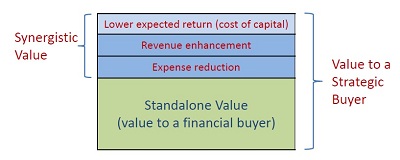

In successful M&A deals involving substantial synergies, the deal price usually falls in the range between the standalone fair market value of the target business and that value plus the full value of potential synergies.

Value of potential synergies?

Increased value (over and above fair market value) to a strategic buyer, involves synergies between the acquired and acquiring firm and the additional financial returns and therefore value created by those synergies . There is a “1+1=3” effect in the acquisition process. Synergies come in various forms, including an ability to increase revenues of the target firm, cost savings by eliminating redundancies or achieving economies of scale through combining of business units; and the reduction of risk through, for example, increased size and stability, greater management depth or vertical integration.

How much of this synergistic value component is paid in practice?

Buyers pay, on average, 31% of the average capitalized value of expected synergies to sellers, according to recent research by the Boston Consulting Group. The March 2013 BCG article, titled “How Successful M&A Deals Split the Synergies”, can be viewed here.

From an acquirer perspective, why pay for synergies at all?

Because sellers usually anticipate buyers’ synergies and demand to be paid something for them, particularly when multiple strategic buyers are present. In addition, when the buyer is a public company , markets usually react favorably and boost the value of the acquirer when a strategic acquisition is announced. Of course, this increase in value may vanish if the synergies don’t actually materialize! When paying more than fair market value, strategic acquirers must be certain that there will be synergies in the combination. They do not randomly shell out big bucks. The owners of firms that appeal to strategic buyers have a greater opportunity to maximize value in an M&A sale process.

However, not every firm is a strong candidate for a strategic sale.

Most willing buyers for small companies are financial buyers who will operate the business similarly to the way it is operating now, and are normally willing to acquire a company for fair market value. Individual owner-operators, management employees and private equity buyers are examples of financial buyers.

We are always happy to discuss how buyers would typically value of your company. Valuations play a part in all strategic transactions, tax, and many litigation matters. For additional information or advice on a current situation, please do not hesitate to call.

– See more at: https://exitstrategiesgroup.com/blog.html?bpid=3676#sthash.rrhDOJwx.dpuf

Exit Fundamentals: Two ways to Sell a Business

This article introduces the two fundamental methods of transferring a 100% interest in a private business, a) an “Asset Sale” and b) a “Stock Sale”. Asset Sales account for more than 90% of small business transactions. By small I am thinking of businesses with up to $10 million in revenue.

Asset Sales

In an Asset Sale the seller sells all of the tangible and intangible assets of the business, and ends up retaining the legal entity, which the seller then winds down (or uses for another business purpose). The seller terminates the employees (and pays out any accrued vacation), and the buyer typically rehires substantially all of them. In effect, the buyer starts a new business using the assets purchased from the seller. When the buyer is a complementary or competing business, an asset sale often involves less than the seller’s entire basket of assets.

A company’s basket of assets typically includes: cash and equivalents, accounts receivable, inventory, work in process, deposits, equipment, trade fixtures, leasehold, leasehold improvements, contracts, business records, software and software licenses, licenses and permits, franchises, covenant not to compete, trade secrets, patents, intellectual property, trade name, customer lists, marketing materials, telephone numbers, web sites, URL’s, email addresses, sales order backlog and goodwill.

Leases and other contracts are assigned to the buyer, and certain liabilities may be assumed by the buyer. Often, the seller keeps any cash and deposits and pays off all liabilities of the business, delivering title to the assets free and clear of all liabilities.

Stock Sales

If the business is a corporation (or other legal entity) then the individual who owns the shares in the corporation can sell their shares to a buyer. This is a stock sale. The buyer buys the entire balance sheet. Debt remaining on the balance sheet is usually considered part of the payment of the purchase price. The most recent balance sheet or a target balance sheet is attached to the purchase offer (usually a letter of intent or LOI) and there is language in the offer that adjusts the price for any changes in net working capital or debt that occur between the LOI signing and the transaction closing.

Asset Sale Pro’s and Con’s

There are several advantages and disadvantages to the parties in an asset sale (versus a stock sale). Here are some of them:

| ADVANTAGES | DISADVANTAGES | |

| BUYER | □ “Step Up” in basis for depreciation and amortization

□ Free of most contingent liabilities □ Can select assets to purchase □ Can change entity type, state of registration □ Due diligence less extensive |

□ Transaction more complex

□ Lose non-transferable rights □ Unable to carry over tax losses, if any □ Have to reestablish credit, licenses, permits, etc. □ Require consents to assign contracts |

| SELLER | □ Retain corporate entity

□ Can keep certain assets (e.g. patents) □ Usually higher price |

□ Double taxation (C Corp’s)

□ Depreciation recapture □ Transaction more complex |

Buyers usually want to buy assets for two reasons:

1) They can write up the value of depreciable assets and depreciate them again, and amortize all of the goodwill value, and

2) They avoid any liabilities that might arise after closing that were caused by events that occurred before the transfer of ownership. Stock sale terms usually include the seller holding harmless and indemnifying the buyer against undisclosed or contingent liabilities, but what if the seller has already spent the money or refuses to pay! Of course you would do that, but that’s what worries buyers.

For the owner of a “C” corporation an asset sale (versus stock sale) normally has a far less favorable tax treatment. If you own a C Corporation, you should talk to your CPA about converting it to an S Corp.

This is a very basic introduction to this topic, and don’t take this as legal or tax advice. In addition to a broker/M&A advisor, you must always have experienced legal and tax experts on any transaction team and in any exit planning process. To discuss your circumstances, feel free to give us a call.

“If you don’t know where you are going, any road will get you there.”

I’m amazed at how many business owners think about exiting all the time but never do any real exit planning. The most successful business owners I know have an exit plan on the day they open their doors. Their business decisions are synonymous with the plan. To navigate without a destination is like “trying to hold the wind up with the sail,” as Willie Nelson once sang.

As you go through the years in your business, are you focused on building equity? Business equity grows when you pay down debt, increase cash flow and add tangible and intangible assets (intellectual property rights, brand, etc.). On exit, it is this equity that is your 401K retirement, reinvestment cash for another business investment or possibly very early retirement.

Having an exit plan for your business is like setting any type of major goal — it keeps you focused on the things that really matter. Here are some things to consider:

1. Set a financial goal. How much money do you want to receive from a sale to ensure financial security? This is the most important question as it will drive proactive business and investment decisions. Examples include: a) diversifying into new markets, b) adding new product or service offerings, c) acquiring or merging with other businesses, and d) automating internal business processes.

2. Understand value and salability issues. With the help of your advisors, you need to know how to drive value in your business so that it is consistent with the financial goal you have set. Salability deals with internal business conditions and external market conditions that affect marketability (the size of your buyer pool), transferrability, and how much leverage you will have when negotiating with buyers. External conditions are usually not in your direct control, such as market changes, industry or financial conditions. For example, your goal to receive all cash from a buyer may not be possible because of a downturn in your business or industry.

3. Tax and legal consequences need to be evaluated. For example, if your company is a C-corporation and you sell only the assets (name, goodwill & trade, fixtures, furniture, equipment, vehicles, inventory, work in process, etc.) there would be significant adverse tax consequence as compared with selling the assets of an S-corporation, partnership, LLC or sole proprietorship.

It’s never too late to begin exit planning. By doing so, you will be able to narrow the list of exit routes to determine which one is best and consistent with your long term goals.

Transaction brokers create competition. Why is this so important?

The critical first step in selling a business is to properly analyze and value it to establish a price. In the case of an undervaluation, when the business is sold the result is obvious; the owner receives less. Conversely, businesses that are overvalued and overpriced usually do not sell. The reason for this is because of the principle of alternative investments, which states that rational buyers will act on some alternative business investment where they expect to earn a higher return on their invested capital. Setting a reasonable price is critical to a successful deal. Buyers won’t spend time pursuing overpriced opportunities.

All business valuations are based upon the expectation of future economic benefit. An investor, appraiser and transaction broker (investment banker, M&A advisors, et al) looks at historic earnings or cash flows (usually 5-years or more if available) along with other factors such as the current economic environment and outlook, industry trends and outlook, and internal business factors. From this analysis, when the earnings stream is expected to grow at a fairly constant rate over time, the valuator estimates the next year’s earnings stream, which is then converted into value using a risk-adjusted rate of return; as a devisor (capitalization rate) or multiple (1/capitalization rate) derived from market sources for similar investments. Note that the earnings stream is forecasted in harmony with the basic premise of value — the “future expectation of economic benefit.”

In addition to this critical valuation piece, the transaction broker creates competition in the market, or at least the perception thereof.

There are two categories of buyers: Financial Buyers, which include the typical individual owner-operator or investor group who usually pay fair market value (FMV); and Strategic Buyers, which is a company that has a specific business reason to purchase and has synergies with that business. Because strategic buyers get more earnings and therefore value out of an acquisition than the FMV of the target company, they may be willing to pay a premium price.

The existence of competition in the market, among financial or strategic buyers, usually results in the ultimate price paid being higher than if no competition exists.

In my 20 years of M&A experience, I have found that getting strategic buyers to pay more than FMV when there is no competition is difficult. When a business is marketed by a transaction broker, competition normally drives the purchase price upward, much like an auction environment.