Early-Stage Tech Company Exits

You’ve built a world-class software solution, delivered to customers as a SaaS application or web service. You’ve recruited a team and created intellectual property. Customer retention is strong and the buzz is growing in your vertical market. Each new customer acquisition represents incremental recurring revenue that falls directly to your bottom line – and the company is closing in on cash flow positive territory.

Could this be the right time to sell the company?

You may be thinking, I’ve barely scratched the surface of the company’s income potential. Why sell at this juncture? The key is that you’ve built the engine for future financial returns. Perhaps a strategic acquirer with more marketing muscle or an existing customer base can turbo charge sales and edge out the competition better than you can on your own. Or perhaps you’re a serial entrepreneur who’s strength is starting companies, and you’re ready for a new challenge. There could be any number of reasons why selling at this stage makes sense.

When implementing an exit strategy, early stage companies must select the right strategic M&A partner. Start-ups that are short on track record and long on vision and promise represent a unique species in the M&A market. Investment banking firms typically charge hefty fees, and prefer working with larger, later-stage clients. On the other end of the spectrum, business brokers are generally unaccustomed to working with IP-focused technology clients. If you’re caught in this under-served market niche, Exit Strategies Group can help. We focus on lower middle market clients, and have the skills and experience to value, package, market, and sell early-stage companies successfully.

One of your first questions will likely be, “what’s my tech start-up worth?”

Factors Affecting Small Tech Company Valuation

- Annual revenues and revenue growth rate

- How revenues are obtained (licensing fees vs subscription)

- Profitability

- Customer retention

- Strength of management team, and post-acquisition longevity

- Growth of the underlying industry

- Intellectual property

- Technology leadership

- Market share

- Viral adoption

In 2016, there were several noteworthy deals in the public markets. While these public company transactions do not reflect how an early-stage privately-held tech company will be valued, it’s interesting to note the relative multiples of these deals:

| Seller | Buyer | Revenues | Transaction | Rev. Multiple |

| Microsoft | $2B | $26.2B | 13.1 | |

| Demandware | Salesforce | $2.37M | $2.8B | 11.8 |

| NetSuite | Oracle | $7.41M | $9.3B | 12.6 |

| Yahoo! | Verizon | $4.96B | $5B | 1.0 |

Is it surprising that Yahoo! sold at a 1x revenue multiple while the others sold for at least 11x? LinkedIn, Demandware, and NetSuite all have growing revenues, defensible IP, in growing market segments. Yahoo! does not.

Source: Software Equity Group | 2015 Annual Software Industry Financial Report

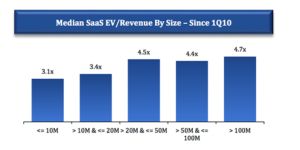

On average, larger companies (in terms of annual revenue) command higher price/revenue multiples. Price/revenue multiples for small early-stage companies typically range from 1X to 3X (with outliers as low as 0.5X or as high as 10X).

When planning your exit, it’s beneficial to understand the broad range of valuation multiples and influencing factors. The underlying value drivers hold true for all size deals. Consider the valuation factors listed above, and make sure your company is firing on all cylinders.

If you have a $1-50 million revenue early stage software or tech business and you’re planning or considering an exit, please contact one of Exit Strategies’ California-based advisors for a free confidential consultation.

With continuing growth in consumer online spending and many high-profile public acquisitions this year, it seems like a great time to sell your online retail business. But things are never quite as simple as they appear.

With continuing growth in consumer online spending and many high-profile public acquisitions this year, it seems like a great time to sell your online retail business. But things are never quite as simple as they appear. Stay bonus amounts are customarily based on the key person’s annual compensation, determined in accordance with the risk and effect of losing them. According to Mercer’s Survey of M&A Retention and Transaction Programs, median stay bonuses paid by U.S. companies range from 25 to 95 percent of base salary depending on the position (see graphic). The way we see this at Exit Strategies is that the stay bonus amount has to be personally meaningful to the key employee. In many of our deals this number is half to two-thirds of a person’s annual compensation.

Stay bonus amounts are customarily based on the key person’s annual compensation, determined in accordance with the risk and effect of losing them. According to Mercer’s Survey of M&A Retention and Transaction Programs, median stay bonuses paid by U.S. companies range from 25 to 95 percent of base salary depending on the position (see graphic). The way we see this at Exit Strategies is that the stay bonus amount has to be personally meaningful to the key employee. In many of our deals this number is half to two-thirds of a person’s annual compensation. What has caused this trend? A number of reasons are generally cited, including:

What has caused this trend? A number of reasons are generally cited, including: