We’re coming off a recalibration year for M&A. While 2021 and 2022 saw record activity, the first half of 2023 was marked by significant declines. Inflation, interest rates, increased capital costs, and geopolitical uncertainty all made buyers wary, and the global market held back on deal making.

Now we’re anticipating an uptick in 2024. This resurgence will be fueled by the continued presence of cash in the marketplace, corporate growth demands, and Baby Boomer retirements. Let’s unpack the key drivers and potential roadblocks ahead:

Record dry powder: Slow activity in the middle market means there’s been a buildup of cash in private equity. Dry powder soared to an unprecedented $2.59 trillion in 2023, an 8% increase over a year ago. Investors continue to favor private equity funds, resulting in this substantial pool of uninvested capital. Private equity is under pressure to deploy this cash, which should translate to heightened dealmaking.

Lower middle market add-ons: The lower middle market (LMM) stayed relatively active in 2023, largely driven by the ease of financing add-on transactions. Compared to larger deals that require hundreds of millions in financing, these smaller investments carry lower price tags, carry smaller amounts of debt, and have the potential to scale faster. These businesses are attractive to buyers seeking to grow their operations.

Talent crunch: Organic growth remains challenging due to the difficulty in attracting and retaining skilled workers. This talent squeeze acts as an incentive for companies to consider M&A as a growth strategy. That said, buyers are wary of businesses with looming retirements or retention problems. Business owners considering an exit in the next couple of years should work to resolve any pending talent gaps.

Onshoring resurgence: The COVID-19 pandemic exposed vulnerabilities in global supply chains, prompting many companies to re-evaluate their production strategies. Onshoring, bringing manufacturing back to the US, has gained traction as a way to mitigate risks, improve responsiveness, and potentially reduce costs.

We expect to see solid interest in manufacturing, particularly in the Midwest, which is known for its skilled workforce. Again, talent issues will play a role. Manufacturers that want to sell in the coming years need to double down on workforce development and recruitment programs that bring younger generations in the door.

Overdue exits: An estimated 10,000 to 11,000 Baby Boomers retire every day, and many of them own businesses. Research suggests that people age 55-plus make up 21% of the population, but own a disproportionate 51% of businesses in the U.S. With more businesses entering the market, and not enough younger generations to take them over, we can expect greater industry consolidation. Private equity firms, family offices, and corporate buyers will likely scoop up many of these companies as they become available for sale. We can expect rollups in fragmented sectors, allowing bigger players to realize new economies of scale.

ESG interest: We’re seeing increased interest in companies with sustainable operations. Many private equity firms are looking for companies to meet their environmental, social, governance (ESG) mandates, driven by both ethical and financial considerations. Companies with B-Corp certification, Fair Trade Certification, Forest Stewardship Council alignment and other unique sustainability stories will garner attention from the ever-growing pool of buyers with ESG goals.

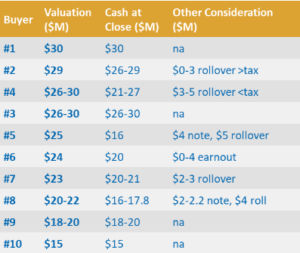

Flight to quality: High interest rates, the upcoming presidential election, and geopolitical uncertainties may present headwinds for the M&A market. When there’s uncertainty in the marketplace, buyers become more selective, prioritizing companies with strong fundamentals, proven track records, and clear growth prospects. These “A” players are still getting strong multiples—and advantageous deal structures—because buyers are willing to pay for quality.

Industry outlook: The M&A landscape in 2024 is poised for a resurgence. While some uncertainties remain around interest rates, politics, and broader economic conditions, the fundamental drivers seem strong. Record dry powder in private equity, the need for strategic growth through acquisitions, and a flood of Baby Boomer retirements all point to strong deal flow over the next couple years.

Quality companies with strong financials, management teams, and growth stories will remain in high demand. Both buyers and sellers should prepare now to take advantage of the open M&A window in the year ahead.

For advice on exit planning or selling a business, contact Al Statz, founder and CEO of Exit Strategies Group, Inc., at alstatz@exitstrategiesgroup.com. Exit Strategies Group is a partner in the Cornerstone International Alliance.

Amick Brown was founded in San Ramon in 2010. The Company provides technology staffing and technology consulting services for government and private sector clients. Customers are located throughout the United States and include many of the world’s largest enterprises. Amick Brown had five active owners. Two were looking to retire; Zest has retained the remaining three partners to continue in their current capacities with Amick Brown under the ownership and direction of Zest.

Amick Brown was founded in San Ramon in 2010. The Company provides technology staffing and technology consulting services for government and private sector clients. Customers are located throughout the United States and include many of the world’s largest enterprises. Amick Brown had five active owners. Two were looking to retire; Zest has retained the remaining three partners to continue in their current capacities with Amick Brown under the ownership and direction of Zest.