So, you’re ready to sell your business. You have an M&A advisor helping you, your numbers are in order, and you’re feeling confident. But did you know that only half of businesses will successfully sell—and that’s with a qualified advisor?

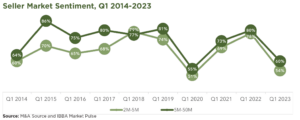

For years, member advisors of the International Business Brokers Association and the M&A Source have been reporting their quarterly closing rates in the Market Pulse Report. Every quarter, roughly 50% of deals terminate without a successful sale. And these are professionals who invest in their craft and their career.

In fact, analysts estimate the actual closing rate for small and medium businesses is closer to 25-30%. That number includes business owners who try to sell on their own as well as those who list with real estate agents, lawyers, and other “hobbyist” M&A advisors.

What makes the failure rate so high? Advisors in the Q4 2022 Market Pulse Report were asked to share why their deals failed. Here’s a breakdown by sector:

Main Street failures due to financials and financing

In the Main Street market, that is businesses valued at less than $2 million, poor financials and financing problems were the leading reasons companies didn’t sell.

There are any number of reasons a business isn’t performing well, and many factors (like economic swings, bubbles, and pandemics) are outside an owner’s control. But some sellers hold on too long, waiting until they’re burned out or the business has evolved past their skill set.

Generally, you’ll get the best value for your business when you go out on a growth trend. Once a business is on a downward slide, it gets harder (and sometimes impossible) to sell.

As for financing the Main Street market, banks generally prefer to lend off hard assets, not cash flow, and individual buyers can struggle to raise the capital they need. That can leave a bit of a no man’s land at the upper end of the market, unless the deal qualifies for an SBA loan.

A small business is a lifestyle operation for many owners, generating a sufficient income. Meanwhile, many buyers in this market are looking to “buy a job.” But at a certain scale, the business doesn’t generate enough profit for the buyer to both earn a living and pay debt service. These deals are tough to get done.

Unrealistic expectations plague lower middle market

In the lower middle market, where businesses are valued between $2 million and $50 million, seller expectations become the bigger concern. In these situations, the seller believes their business is worth more than the market will bear. When the advisor can’t deliver on those lofty goals, the engagement terminates.

In an ideal world, advisors wouldn’t even take these deals. You can do a lot of harm by testing the market with unrealistic expectations. You can burn through buyers, risk confidentiality, and weaken your own drive to keep the business performing.

The market ultimately determines the value, not what you want or need out of the business. It’s important to trust your advisor and the process they’re running. If they’re reaching a large pool of capable buyers, then you probably have a true reflection of the demand for, and value of, your business.

Economic uncertainty played a role

For Main Street and the lower middle market together, advisors reported that economic uncertainty was the second leading cause of deal failure. Just five or six months ago inflation was rising, and economists were warning of a recession in 2023. (Now they’re predicting a “shallow” downturn in 2024.)

When there’s uncertainty in the market, deals get shaky. If it’s a perfect business, the transaction still gets done. But if there’s any hair on it, lending can be a problem. Equity shortfalls can trigger a price adjustment and bad feelings follow. Other times, buyers simply hit the pause button while they wait to see what the economy will do.

Plan ahead to avoid pitfalls

It’s important to understand why businesses fail to sell. Poor financials, financing, risk conditions, delays, and unrealistic expectations all play a role.

Business owners should get a regular estimate of value so they know what their business is worth and how to increase that value in a future sale. Advance planning can help you make informed decisions and put your business in the best position for success.

Remember, deals can fall apart for any number of reasons, and market conditions can change rapidly. But with the right mindset, preparation, and advisor, you can find yourself on the right side of that 50/50 statistic.

For advice on exit planning or selling a business, contact Al Statz, CEO of Exit Strategies Group, Inc., at alstatz@exitstrategiesgroup.com. Exit Strategies Group is a partner in the Cornerstone International Alliance.