A significant number of business owners do not know how much their business is worth. That can be a source of conflict in the face of unfortunate events such as a divorce or a partnership separation. But it can be even more painful when the business owner plans to retire, only to find out the business isn’t worth as much as they expected.

These owners may have harbored lofty expectations based on personal attachment, historical performance, or their own inexperienced assessments, only to face a stark reality when confronted with a lower-than-expected valuation. It’s difficult news that can lead to dashed retirement dreams.

Maybe the owner has to work years longer than expected to build the business to the valuation they want and need. Worse yet, some business owners cling to their misplaced expectations, resisting calls from spouses or business partners to sell. Over time, distractions, frustrations, or external factors beyond their control can lead to declining business performance, and the business no longer becomes salable at all.

Let’s explore some of the reasons why business owners may experience such unwelcome surprises and shed light on the factors that can impact a business’s worth:

1. Emotional attachment: Business owners often have a personal and emotional attachment to their business, which skews their perception of its worth. Unfortunately the time, effort, and resources you’ve put into building a company do not always translate into transferrable value.

2. Lack of financial documentation: Another common problem that catches business owners off guard is a lack of proper financial documentation.

This happens frequently in bars, restaurants, and other cash-based operations. Sometimes owners make the mistake of not reporting income in order to save on taxes. But every dollar saved in annual taxes can cost three or four times (or more) as much in lost business value at the time of sale.

Even so, this is a problem even larger, non-cash businesses can deal with. If a business owner has not maintained accurate and up-to-date financial records—tracked according to standard accounting practices—it can be challenging to show the company’s true financial performance.

3. Overreliance on historical performance: Business owners might assume that historical financial performance automatically translates to current value. And it’s true that buyers will tune into the last 12 months’ financials. However, buyers are also looking at future earning potential.

They take various factors into account, including your company’s gross profit and EBITDA margins. Are your margins shrinking or growing? What about the market and the competitive landscape? If the business’s historical performance is not indicative of its current or future potential, the valuation might be lower than expected.

4. Concentration of risk: A business heavily reliant on a few key customers, suppliers, or employees poses a risk to potential buyers. If the value of the business is significantly tied to specific individuals or relationships that may not transfer upon a sale, that will impact the valuation.

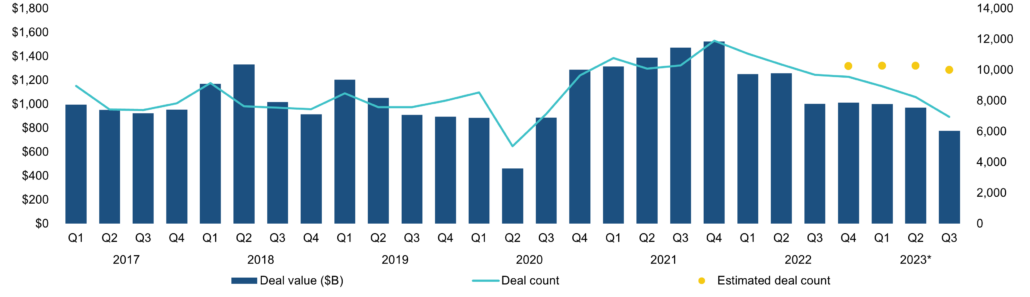

5. Industry and market factors: External factors, such as changes in the industry or market conditions, can influence the value of a business. If the industry is experiencing a decline, changing trends, or disruptive technological advancements, the value of the business may be lower than anticipated.

6. Unrealistic growth projections: Business owners sometimes have overly optimistic growth projections that are not supported by market data or a realistic assessment of the business’s potential. If growth projections are unrealistic or lack substantiation, it can negatively impact the valuation.

It’s not good enough, for example, to say, “We don’t do any marketing. All you have to do is market the business and sales will grow.” Such a claim linked to a “hockey stick projection” (i.e., flat growth followed by a sharp increase) can hurt your credibility with buyers.

7. Lack of professional guidance: Without proper guidance from business advisors, such as an M&A advisor or valuation expert, owners may not fully understand the factors that impact what their business is worth. Seeking professional advice can help an owner manage expectations or, better yet, adjust business strategy toward supporting their valuation goals.

Each business is unique, and the factors affecting a valuation can vary. It’s generally a good idea to keep tabs on what your business is worth over the years. Consider getting an affordable estimate of value every two to three years so you know where your business stands. You don’t want to be caught off guard by any negative surprises at retirement time.

For advice on exit planning or selling a business, contact Al Statz, CEO of Exit Strategies Group, Inc., at alstatz@exitstrategiesgroup.com. Exit Strategies Group is a partner in the Cornerstone International Alliance.