Request a Strategy Call and we will get in touch with you

Thinking of Selling Your Business? Don’t Let Built-In Gains Tax Surprise You.

I was recently asked by “Chester” to help him sell the $10 million service company he founded 24 years ago. Chester, who is 65 years old, has had some health concerns and wants to travel the world with his wife Margie. Two of his competitors have been acquired in the past 3 years by strategic buyers. His business is doing well and he thinks the time is right to sell. In Chester’s industry, almost all acquisitions are asset (versus stock) purchases.

When Chester told me that he converted from a C- to an S-Corporation 6 or 7 years ago, we asked his CPA to estimate his tax burden if he sells now. It turns out Chester faces a large Built-In Gain (BIG) tax bite, which was a surprise to him. In my experience as an M&A advisor, Chester is not alone. Many S-Corporation owners are unaware that such a monster is lurking in the shadows.

What is a Built-In Gain?

C-Corporation owners face a “double tax”, where gains on a sale of assets are taxed at the corporate level and subsequent dividends are taxed at the shareholder level, whereas in an S-Corp there is no federal corporate level tax. Congress’ enactment of built-in gains tax was intended to prevent C-Corp owners from making an S election just before selling their companies’ assets to avoid corporate-level taxes.

When a C-Corp converts to an S-Corp, a “built-in gain” is determined, based on the Fair Market Value of the corporation’s assets (both tangible and intangible) less the tax basis in the assets on the date of conversion. Essentially, built-in gain is the gain that would have been taxed had the C-Corp sold its assets on the conversion date. Built-in gain should be determined, in the eyes of the IRS, by a business valuation prepared by a qualified independent business appraiser, as of the conversion date.

How much is the tax and how long after C to S conversion does it apply?

Built in gains was codified in 1986 in Internal Revenue Code Section 1374. Per the code, an S-Corporation is subject to a Built-In Gain tax for 10 years from the first day of the year of conversion from C to S. And yes, Built-In Gain tax is commonly called the “BIG Tax”. Who says the IRS doesn’t have a sense of humor!

For Federal purposes, at the corporate level, built-in gains are taxed at 35%. Additionally, a dividend tax at the shareholder level is assessed, and state taxes are assessed at both the corporate and shareholder level.

IRC Section 1374 was amended to reduce the 10-year recognition period to 7 years for asset sales occurring in companies’ 2009 and 2010 tax years, and to 5 years in 2011. The American Taxpayer Relief Act of 2012 extended the temporary 5-year recognition period to 2012 and 2013. By the way, California continues to require a 10-year holding period. Welcome to California; now open your wallet!

Unless Congress acts, if a Company sells in 2014, the original 10-year recognition period will apply. That means there might be a real incentive to close a sale before the end of this year. Otherwise an S corporation owner might want to hold on long enough to outlast the 10-year BIG recognition period. This is the decision Chester made. At 65 years old with declining health, Chester made a gut-wrenching choice that involves real financial risk and adds emotional stress to his next few years in business.

So what should S-Corp owners with a BIG problem do?

- If you own a C-Corp and your expected holding period is 10 years or more, seriously investigate converting to an S-Corp now.

- If you previously converted from a C-Corp to an S-Corp, and you plan to go to market within your BIG window, be sure to have an independent, IRS-compliant business valuation prepared as of the date of conversion. Valuations can be prepared retrospectively.

- If you’re considering selling now, close your deal before the temporary 5-year BIG window reverts to 10 years in 2014. Time is running out if you want to hit this window.

- When an asset sale is reported for tax filing, the selling price is allocated among the various assets sold (AR, inventory, equipment, goodwill, etc.) If you sell next year, one way to reduce (though probably not escape) the BIG tax is to allocate part of the sale price to personal assets, such as personal goodwill. However, personal goodwill is not justifiable in many businesses, and any attempt to allocate price outside the corporation will be closely scrutinized by the IRS, and should be supported by an independent valuation.

Please be sure you understand the tax consequences of a sale of your company, whether you plan to sell this year or several years from now. Exit right, retire well!

Business valuations play an important part in many tax matters, and exit planning for business owners increases their chances of a successful exit. For additional information or for advice on a current need, please do not hesitate to call Al Statz at 707-778-2040 or Email alstatz@exitstrategiesgroup.com.

Role of Business Appraisers and M&A Advisors in Estates and Trusts

I was recently asked about Exit Strategies’ role as business appraisers and M&A advisors in estates, estate planning and trust administration. Here was my answer …

Business Valuation (a.k.a. Appraisal)

As business valuation experts, we provide fair market value appraisals of closely-held corporations, FLPs and LLCs for estate planning, gifting, estate tax, charitable donations, buy-sell transactions and succession planning. We value fractional interests in operating companies and asset holding companies using appropriate discounts. Our appraisers adhere to recognized professional standards, perform appropriate due diligence and meet or exceed accepted reporting requirements. And of course we are prepared to defend our work in the unlikely event of an IRS challenge.

For estates containing closely held business interests, we determine value of the decedent’s interest. We can provide input to the attorney on the effect of using the alternative valuation date.

With regard to trust administration, when a privately held business interest is placed in trust, our business valuation can help the fiduciary establish a baseline value and enhance their understanding of the asset. An independent business valuation can also avoid any potential for conflict of interest, since fees charged by trustees are often based upon the value of the assets managed. Subsequent valuations may be ordered by the fiduciary to assess the investment’s performance over time.

In estate planning where a family business is one of the owner’s major assets, a business valuation is often the starting point for estate planning professionals as they consider various estate planning techniques. Valuations provide a basis for the owner to evaluate potential ownership transfers and gifts; and can safeguard against future IRS challenges.

Landscape photo by Lance Kuehne

When drafting entity agreement and buy-sell agreement terms, attorneys have to balance flexibility and efficiency of operations with restricting control and marketability. During this stage, we can identify problem valuation situations or problem assets and identify the effects of gift and estate planning alternatives on valuation. We can also provide feedback and input on operating agreement terms that impact value.

When business owners gift ownership in their businesses, we determine value as of the date of gift. When closely held business interests are donated to a Charitable Remainder Trust (CRT), our business valuation can support the charitable deduction by the donor taxpayer.

Sometimes estate planning involves business succession planning. Like estate planning, real business succession planning is emotionally charged and often meets with resistance from clients. A business valuation provides an objective look at many aspects of a business, including its management, marketability, inherent risks, and future prospects. The very act of going through the valuation process with an experienced and independent appraiser sometimes provides the catalyst that owners and their families need to fully engage in succession and wealth transfer planning.

M&A Advisors (a.k.a. business brokers, investment bankers, intermediaries, etc.)

There are many instances in which a generational transfer of a family-owned business is not the best option for a family. Often the children aren’t qualified to run the company or simply aren’t interested. Or the industry may be consolidating and an opportunity exists to sell the business for far more than fair market value and create substantial wealth and liquidity for the family.

Here, our firm regularly advises owners in the positioning, document preparation, strategic marketing and confidential selling process. We lead the M&A sale process for the client and work alongside their tax and legal advisors to maximize proceeds and preserve wealth.

Business valuations and M&A brokerage play a part in many estate and trust matters and succession planning for family owned businesses. For additional information or for advice on a current need, you can call Exit Strategies’ founder and president Al Statz at 707-781-8580.

Do Strategic Buyers Share Synergies with Sellers?

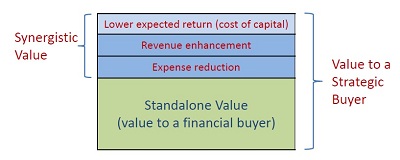

In successful M&A deals involving substantial synergies, the deal price usually falls in the range between the standalone fair market value of the target business and that value plus the full value of potential synergies.

Value of potential synergies?

Increased value (over and above fair market value) to a strategic buyer, involves synergies between the acquired and acquiring firm and the additional financial returns and therefore value created by those synergies . There is a “1+1=3” effect in the acquisition process. Synergies come in various forms, including an ability to increase revenues of the target firm, cost savings by eliminating redundancies or achieving economies of scale through combining of business units; and the reduction of risk through, for example, increased size and stability, greater management depth or vertical integration.

How much of this synergistic value component is paid in practice?

Buyers pay, on average, 31% of the average capitalized value of expected synergies to sellers, according to recent research by the Boston Consulting Group. The March 2013 BCG article, titled “How Successful M&A Deals Split the Synergies”, can be viewed here.

From an acquirer perspective, why pay for synergies at all?

Because sellers usually anticipate buyers’ synergies and demand to be paid something for them, particularly when multiple strategic buyers are present. In addition, when the buyer is a public company , markets usually react favorably and boost the value of the acquirer when a strategic acquisition is announced. Of course, this increase in value may vanish if the synergies don’t actually materialize! When paying more than fair market value, strategic acquirers must be certain that there will be synergies in the combination. They do not randomly shell out big bucks. The owners of firms that appeal to strategic buyers have a greater opportunity to maximize value in an M&A sale process.

However, not every firm is a strong candidate for a strategic sale.

Most willing buyers for small companies are financial buyers who will operate the business similarly to the way it is operating now, and are normally willing to acquire a company for fair market value. Individual owner-operators, management employees and private equity buyers are examples of financial buyers.

We are always happy to discuss how buyers would typically value of your company. Valuations play a part in all strategic transactions, tax, and many litigation matters. For additional information or advice on a current situation, please do not hesitate to call.

– See more at: https://exitstrategiesgroup.com/blog.html?bpid=3676#sthash.rrhDOJwx.dpuf

“If you don’t know where you are going, any road will get you there.”

I’m amazed at how many business owners think about exiting all the time but never do any real exit planning. The most successful business owners I know have an exit plan on the day they open their doors. Their business decisions are synonymous with the plan. To navigate without a destination is like “trying to hold the wind up with the sail,” as Willie Nelson once sang.

As you go through the years in your business, are you focused on building equity? Business equity grows when you pay down debt, increase cash flow and add tangible and intangible assets (intellectual property rights, brand, etc.). On exit, it is this equity that is your 401K retirement, reinvestment cash for another business investment or possibly very early retirement.

Having an exit plan for your business is like setting any type of major goal — it keeps you focused on the things that really matter. Here are some things to consider:

1. Set a financial goal. How much money do you want to receive from a sale to ensure financial security? This is the most important question as it will drive proactive business and investment decisions. Examples include: a) diversifying into new markets, b) adding new product or service offerings, c) acquiring or merging with other businesses, and d) automating internal business processes.

2. Understand value and salability issues. With the help of your advisors, you need to know how to drive value in your business so that it is consistent with the financial goal you have set. Salability deals with internal business conditions and external market conditions that affect marketability (the size of your buyer pool), transferrability, and how much leverage you will have when negotiating with buyers. External conditions are usually not in your direct control, such as market changes, industry or financial conditions. For example, your goal to receive all cash from a buyer may not be possible because of a downturn in your business or industry.

3. Tax and legal consequences need to be evaluated. For example, if your company is a C-corporation and you sell only the assets (name, goodwill & trade, fixtures, furniture, equipment, vehicles, inventory, work in process, etc.) there would be significant adverse tax consequence as compared with selling the assets of an S-corporation, partnership, LLC or sole proprietorship.

It’s never too late to begin exit planning. By doing so, you will be able to narrow the list of exit routes to determine which one is best and consistent with your long term goals.

Congress Passes American Taxpayer Relief Act of 2012

During the early morning hours of Tuesday January 1, 2013, the Senate passed a bill that had been heralded and, in some quarters, groused about throughout the preceding day. By a vote of 89 to 8, the chamber approved the American Taxpayer Relief Act, H.R. 8, which embodied an agreement that had been hammered out on Sunday and Monday between Vice President Joe Biden and Senate Minority Leader Sen. Mitch McConnell, R-Ky. The House of Representatives approved the bill by a vote of 257-167 late on Tuesday evening, after plans to amend the bill to include spending cuts were abandoned. The bill now goes to President Barack Obama for his signature.

With some modifications targeting the wealthiest Americans with higher taxes, the act permanently extends provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001, P.L. 107-16 (EGTRRA), and Jobs and Growth Tax Relief Reconciliation Act of 2003, P.L. 108-27 (JGTRRA). It also permanently takes care of Congress’s perennial job of “patching” the alternative minimum tax (AMT). It temporarily extends many other tax provisions that had lapsed at midnight on Dec. 31 and others that had expired a year earlier. Among the tax items not addressed by the act was the temporary lower 4.2% rate for employees’ portion of the Social Security payroll tax, which was not extended and has reverted to 6.2%.

For more information on how the act impacts businesses and individuals: https://en.wikipedia.org/wiki/American_Taxpayer_Relief_Act_of_2012

Expiration of $5.12 Million Gift Tax Exemption Presents Unique Gifting Opportunity

As a result of the tax cuts enacted under former President George W. Bush and extended under President Barack Obama, the estate and gift tax currently is set at a maximum rate of 35% with a $5.12 million exemption amount. But unless Congress takes action, the maximum estate and gift tax rate will revert to 55% and the exemption amount to $1 million, effective January 1, 2013.

It is uncertain what, if anything, Congress will do. But given the impending “fiscal cliff” and substantial pressures to increase taxes, particularly on those with high net worth, there would appear to be a significant possibility that the estate and gift tax environment will become less favorable after the end of 2012.

As a result, there could be a one-time opportunity to make substantial gifts without incurring gift tax. Since the gift and estate taxes are unified, an individual currently can make gifts up to $5.12 million (and a married couple up to $10.24 million) without incurring gift tax. These amounts are set to reduce to $1 million for an individual and $2 million for a couple, effective January 1, 2013.

Exit Strategies appraises operating companies and asset holding companies for gifting, estate tax, and other purposes. You must establish fair market value of gifted assets as of the date of gift, and an independent valuation by a qualified business appraiser is often your best defense against an IRS challenge. For fractional interests, we quantify appropriate discounts for lack of control and marketability. Our quality valuation reports comply with USPAP and IRS business valuation standards, and we are prepared to defend our work in the unlikely event of an IRS audit.

If you think you might benefit from making sizeable gifts before year-end, contact your CPA and/or tax attorney right away, while there still is time to formulate and implement an appropriate strategy. Time is running out.

October 25th Seminar: Maximizing the Value of Your Business

In this fast-paced workshop, business owners learn …

- Valuation basics

- Factors that increase enterprise value and marketability

- Steps to developing your exit strategy

- Steps in a proven M&A selling process

- Current market conditions and trends

- Tax implications and impending changes

- Answers to many common questions that owners have

This is essential information for private business owners who wish to sell in the next 1-5 years. It is not too early to plan the successful exit you deserve.

When: Thursday, October 25th, 4:00 to 6:30 pm

Where: Petaluma, California

Presenters: Al Statz and Bob Altieri of Exit Strategies, and David Fisher CPA

More Information: Call 707-778-2040 or Email info@exitstrategiesgroup.com for availability and further information.

For confidentiality, we limit attendance to one business owner per business type and pre-register all participants.

Small Business Acquisition Financing: What Lenders Want

In ten years of selling private businesses, financial leverage has consistently been one of the key success factors in expanding the pool of buyers and closing deals. Fortunately for business owners, the SBA loan guaranty program is an excellent funding source for deals up to $5MM. And, lenders are lending now. A lender analyzes both the buyer (borrower) and the business being purchased. Here are 10 things lenders look for when evaluating a loan request for a small business sale/acquisition:

1. Down Payment. Lenders want a buyer to inject 15%-25% of the total project in cash, depending on several factors including whether real estate is included in the sale. Common down payment sources are retained earnings, savings, retirement plan funds and gifts from family members. Your cash injection cannot be borrowed.

2. Creditworthiness. Lenders investigate a buyer’s credit at the outset of the approval process. A bankruptcy, foreclosure or judgment usually nullifies their chances, no matter how good other criteria look. Remove blemishes from your credit history before you apply.

3. Track Record. Individual buyers must have experience in the type of business and/or industry they are buying into. Lenders look for management experience, and they prefer to see prior business ownership. Tailor your resume to highlight your management and applicable industry experience.

4. Cash Flow is King. Business cash flows must service the loan and provide adequate income for the owners. Lenders analyze the historical tax returns of the business—allowing reasonable adjustments for owner perquisites and non-recurring costs. The quality of financial records comes into play here. Your business plan also comes into play. Synergistic benefits, increases in working capital and capital expenditure needs are considered in the cash flow calculation.

5. Collateral. Buyers with real property to pledge as collateral may compensate for weaknesses in debt service coverage, business assets, experience, credit, or liquidity. Generally, if you have equity in real property, the SBA requires that it be used to secure your business acquisition loan.

6. Positive Trend. Nothing scares lenders more than negative sales and earnings trends in a business or its industry. Conversely, a pronounced positive trend is a thing of beauty to a lender. They often look back several years to see how the business performed through past economic cycles.

7. Business Plan. Buyers have to submit a basic business plan for the business they are acquiring. Lenders want to see an intimate understanding of the business and industry. In most cases a plan calling for modest growth and incremental change is your safest bet.

8. Continuity. Commitments by existing managers, key personnel, suppliers and customers to continue with the new owner represents reduced risk to a lender.

9. Seller Training. Lenders want to see a well thought-out management transition plan. The training/transition period can be anywhere from 1-12 months, depending on circumstances. Be sure you negotiate this point up front and clearly spell it out in the purchase agreement.

10. Seller Financing. When a seller finances even 10-15% of a deal, subordinated to the bank note, it shows the lender that the seller is confident in the business under the buyer’s leadership. This deal point is commonly imposed by lenders.

Finally, for loans over $350,000, or whenever a buyer and seller have a close (non-arm’s length) relationship, SBA lenders require a fair market value appraisal from an accredited business appraiser to validate the borrower’s purchase price. The deal can’t exceed the appraised value. Sellers are advised to prepare months or years in advance, to increase their odds of cashing out when they are ready to exit. Ask yourself, does my business qualify?

• • •

Al Statz, CBA, CBI, is President of Exit Strategies Group, Inc., a business brokerage, merger, acquisition and valuation firm serving owners of closely-held businesses in Northern California. He can be reached at 707-778-2040 or alstatz@exitstrategiesgroup.com.

The North Bay Business Journal, a publication of the New York Times, is a weekly business newspaper which covers the North Bay area of San Francisco – from the Golden Gate bridge north, including Marin and the wine country of Sonoma and Napa counties.

October 27th “Maximize the Value of Your Business” Seminar Announced

Exit Strategies announces the next in its series of executive briefings for business owners. At this candid, fast-paced workshop, business owners will learn …

-

Valuation basics & 20 ways to build enterprise value

-

Preparing a successful exit strategy

-

Market conditions and trends

-

Tax advantages of selling in the next 15 months

-

Steps in a successful M&A sale process

-

Answers to common questions

When: Thursday, October 27th, 5:00 to 7:30 pm

Where: Petaluma, California

Cost: Free of charge to private business owners

Presenters: Al Statz, President, Exit Strategies Group, Inc., and David Fisher CPA

Registration Required: Call 707-778-2040, or Email info@exitstrategiesgroup.com. Space is limited. We will confirm attendance.

This is essential information for private business owners who intend to sell in the next 3-5 years. It is never too early to plan ahead to achieve the successful exit that you, your family and partners deserve, and avoid unnecessary surprises.

• • •

Exit Strategies’ executive briefings are free or nearly free workshops on essential topics for private business owners. These topics originate from years spent guiding clients through successful exits, mergers and acquisitions. The sessions are presented by our knowledgeable staff and subject matter experts within our professional network, in a private, small group setting. For confidentiality, we strictly limit attendance to one business owner per business type and pre-register all participants.