Lately I’ve been spending a lot of time working on an acquisition search for a client, and in this process I found many business offerings that were priced far too high and several that were under-priced. From a buyer and seller perspective, overpricing is a massive waste of time. At the other extreme, when price is set too low, seller’s leave hard-earned money on the table. Both situations can easily be avoided by obtaining a proper business valuation before going to market.

Business valuation is an integrated process of research, historic financial review, normalization adjustments, trend analysis, financial ratio assessment, economic and industry conditions and outlook, and detailed company-specific SWOT analysis. Studying the internal strengths and weaknesses of a business, how it compares to its industry peers, and having a detailed understanding of external conditions helps the appraiser properly apply the market and income approaches to value. Relying on financial analysis alone is like trying to climb a mountain face without a rope. You might make it to the top, or it could end in catastrophe!

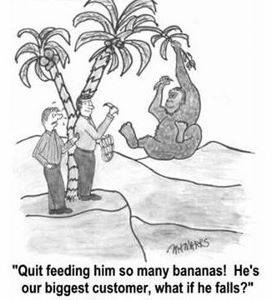

For example, look at the printing industry. Years ago, large expensive printing presses were needed to produce the end product. Capital equipment investment was huge. With the introduction of digital printing and digital media, the opposite is true. If one were valuing a printing company back in the 1990’s and didn’t consider the industry outlook, the value conclusion would have been unrealistic. Another example is when a few customers represent a high percentage of a company’s revenues. The financials may support a higher valuation, but the risk is high and value will be heavily discounted. Banks usually turn down such loans.

Even when an exceptionally high price for a business has been agreed upon, the probability of a successful closing diminishes because of the financing component. Without third-party financing, the number of business sales transactions getting done would be lower, average percentage cash to sellers at the closing table would be less, and average purchase prices would be lower. Financing cannot be ignored.

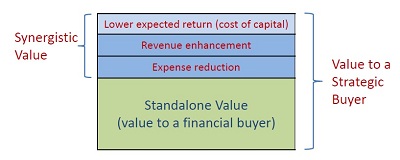

As I discussed in a previous Blog (Reducing Cost of Capital in a Small Business Acquisition, posted Aug 27, 2013), most SBA loans, the primary source of institutional debt financing for small business acquisitions (up to $5,000,000 transaction size), require a business appraisal by a certified appraiser. In such cases, if the agreed upon price is higher than the appraiser’s conclusion of value, the lender will typically loan on the appraised value only. The price of the business has to be reduced, the buyer must come up with more cash (without borrowing it somewhere else), or the seller must finance the excess, without receiving payment for several years.

Market participants should also be aware that lenders and appraisers have to adhere to certain standards when an SBA loan is involved. For example, lenders will not accept certain income statement adjustments, such as state income tax paid by California S-Corporations (most buyers will likely want to form their own S-Corp), health insurance premiums (most buyers will also want to pay this out of the business cash flow), and excessive personal expense adjustments. Also, any representation of cash flows that are not reported on the books is not allowed, for obvious reasons.

Lastly, please remember the Principle of Substitution, which states that “the value of a thing tends to be set by the cost of an equally desirable substitute,” and the fact that buyers have choices in an active market, pricing a business properly is a critical first step toward a successful sale.

Pricing your life’s work at its intrinsic value to you, relying on rules of thumb, or basing it on a broker or accountant’s back-of-the-envelope calculations is usually either a waste of your time or a big financial mistake. When there’s so much at stake, do it right the first time and having your business properly appraised by an expert. It’s just good business.

Thanks for reading, and please let us know when you’re ready to properly price your business. — Bob

Our seller and business valuation clients are usually proud of their company’s long-term relationships with major clients, and with good reason. Having a high percentage of business with a few customers can be a very profitable and personally satisfying way to run a business. It allows management to focus its attention and fine tune company operations to deliver exceptional service in a very cost-efficient manner. Customer acquisition expenses (marketing, sales, estimating, etc.) can be greatly curtailed or eliminated. It’s wonderful while it lasts.

Our seller and business valuation clients are usually proud of their company’s long-term relationships with major clients, and with good reason. Having a high percentage of business with a few customers can be a very profitable and personally satisfying way to run a business. It allows management to focus its attention and fine tune company operations to deliver exceptional service in a very cost-efficient manner. Customer acquisition expenses (marketing, sales, estimating, etc.) can be greatly curtailed or eliminated. It’s wonderful while it lasts.

A new

A new