I recently had a client who wanted to transfer his medical distribution company to his son and retire with peace of mind — a common occurrence these days. Dad and his CPA requested an opinion of Fair Market Value to set the price for a transfer of stock. After I appraised the company (S corp.) stock at $2.0 million, Dad and Son asked me how to finance the transaction. Dad was reluctant to carry a long-term loan for his son — also a common occurrence! Here’s how a team of advisors helped the client make this happen …

The lenders that I approached wanted Son to inject a minimum of $500K (25% of the deal price). This turned out to be a lot more than the son had available. One creative lender suggested that Dad finance the sale for a short time until Son had paid down 25% of the principal on Dad’s note, then return to him for an SBA loan.

The lender proposed 3 seller notes totaling $2 million: Note1 for $500k (25% of the purchase price) for two years, fully amortized; Note2 for $750k with interest-only payments, due in 2 years; and Note3 also interest-only and due in 4 years. The plan was that as soon as Note1 was paid off, the lender would take out Note2 to Dad with a $750k 10-year term loan. Then, after that bank loan was seasoned for 2 years, the lender would lend the remaining $750k to take out Dad’s Note3. The result: Son can acquire the business with no money down, Dad can be completely paid off in 4 years, and Son will have the flexibility of a long-term loan.

When Dad and Son were ready to finalize their agreement, they called a meeting with me and their attorney and CPA. I discovered one significant problem. Under a stock sale, Son’s expected salary and distributions, after taxes, were not quite sufficient to cover his debt service (principal and interest payments) and living expenses in the first two years. During the meeting, I suggested doing an asset sale-purchase instead of the planned stock deal. In an asset purchase, the Son’s net after-tax cash flow would be substantially increased by the stepped up basis of fixed assets and intangibles. After providing rough calculations, Dad and Son received definitive tax advice from their CPA.

Cash Flow Benefits

Let’s look at an example of the difference in cash flow in an asset sale versus a stock sale. Assume a $2,000,000 price in both cases, with inventory and fixed assets as shown in the table below, as well as price allocations to covenant not-to-compete and goodwill under an asset sale.

|

Asset Sale – Buyer |

Stock Sale – Buyer |

| Inventory |

$400,000 (not deductible) |

$400,000 (not deductible) |

| Fixed Assets |

$100,000 (new basis) |

$25,000 (existing basis) |

| Covenant not-to compete |

$50,000 |

na |

| Goodwill |

$1,450,000 |

na |

| Buyer’s total deductions against income |

$1,600,000 |

$25,000 |

|

|

|

| Depreciation of Fixed Assets |

$20,000 / year, 5 yrs* |

$5,000 /year, 5 yrs* |

| CNTC & goodwill combined |

$100,000 / year, 15 yrs |

$0 |

| Total deductions, years 1-5 |

$120,000 |

$5,000 |

*Assume all fixed assets have 5-year depreciation

With an extra $115,000 per year in deductions, and assuming a combined state and federal tax rate of 40%, the Son’s after tax cash flow in an asset purchase would be $46,000 more. Under this structure, the Son’s cash flow would be sufficient to support the debt and enable the ownership transfer.

Dad and Son are now almost a year into their transition. Son is faithfully paying down Note1, the business is doing well, and Dad and Son are happy.

The first moral of this story is that business succession planning and estate planning are team sports, where entrepreneurs need a team of experts to guide them. No single professional is qualified to advise on the range of succession and estate issues that arise.

The planning process often begins with an appraisal of the business and real estate assets, so that tax, financial and legal professionals, lenders, insurers and other team members understand the assets to be transferred. The second moral is that when a business is part of an estate transfer, as in this case, selecting a business appraiser with experience in structuring and financing business sale transactions can be a big advantage!

For further information or to discuss a current need, contact Bob Altieri at ESGI.

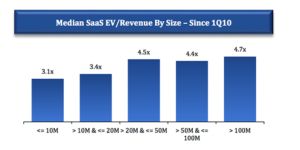

You are getting ready to sell your business so you must ask yourself some questions: When do I want to exit? Who are the most likely buyers? Is my business adequately prepared to sell? How does it compare to other like businesses? And of course, what’s my business worth?

You are getting ready to sell your business so you must ask yourself some questions: When do I want to exit? Who are the most likely buyers? Is my business adequately prepared to sell? How does it compare to other like businesses? And of course, what’s my business worth?

Recurring revenue, simply stated, is the portion of a company’s revenue that is highly likely to continue in the future. An effective recurring revenue model creates a “stickier” relationship between the provider of a product or service and the consumer. Those businesses don’t have to spend as much time and money acquiring new customers.

Recurring revenue, simply stated, is the portion of a company’s revenue that is highly likely to continue in the future. An effective recurring revenue model creates a “stickier” relationship between the provider of a product or service and the consumer. Those businesses don’t have to spend as much time and money acquiring new customers.