You may have heard – it’s a bifurcated market.

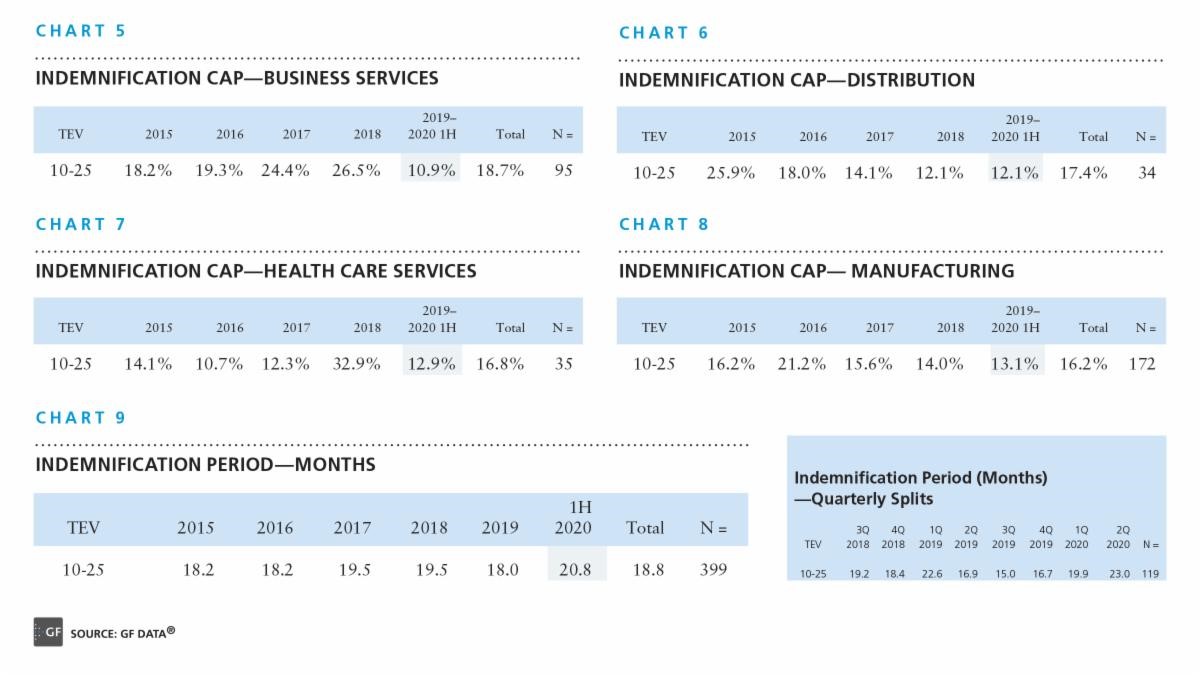

Declining caps on general indemnification against breaches of representations & warranties [1] had been a feature of the seller’s market for lower middle market businesses, going back well before the pandemic. Average caps have remained in the range of 15-16% of Total Enterprise Value (TEV) since the fall of 2020, according to GF Data’s semi-annual report on key deal terms, covering transactions by 243 active private equity data contributors completed through June 30, 2021.

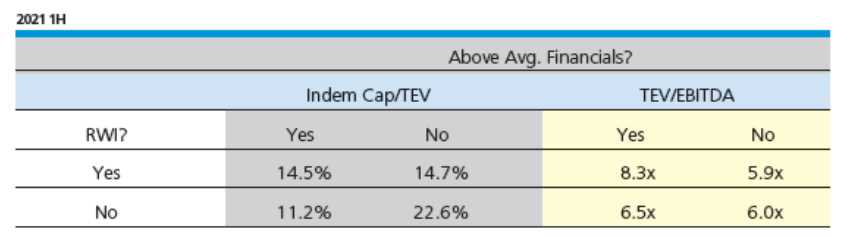

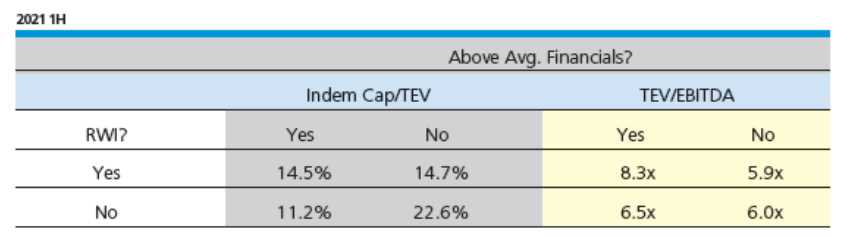

However, a drilldown shows the same kind of market delineation we have seen in valuation. Selling businesses featuring neither above-average financial characteristics (EBITDA margin and revenue growth) nor rep and warranty insurance (RWI) completed deals with an average cap of 23 % of TEV. For businesses offering above-average financials, RWI or both, cap averages were in the low to mid-teens.

The indemnity survival period [2] in the first six months of this year across all industries was 20.3 months, up slightly from the 2016-to-present average of 19.2 months.

The chart below makes clear that businesses with above-average financials and the ability to use RWI are rewarded in valuation. Businesses lacking both are subject to higher caps, in addition to dampened pricing.

In the first half of 2021, utilization of rep & warranty insurance bounced back to 59.1% of all deals. RWI usage anomalously declined in 2020, averaging 53.0% for the year. This reflected a temporary icing of the insurance market following the onset of the pandemic.

GF Data collects and publishes proprietary business valuation, volume, leverage and key deal term data on private equity sponsored merger and acquisition transactions with enterprise values of $10 to 250 million. GF Data gives M&A deal participants and advisors more reliable external information to use in valuing companies and negotiating transactions.

[1] Indemnification cap refers to the general indemnification provided by the seller to the buyer against breaches of reps and warranties. This does not include carveouts for specific issues or items. For example, parties often agree that the general cap will not apply in the event of fraud.

[2] Survival period refers to the period after closing during which a buyer may assert a breach of the reps and warranties against seller. Again, this does not include carveouts. For example, exposure on tax, environmental, and ERISA issues often exceeds the general survival period.

For assistance with selling a lower middle market business, contact Al Statz in Exit Strategies Group’s Sonoma County California office at 707-781-8580 or alstatz@exitstrategiesgroup.com.