Understanding Discount Rates The Company Specific Risk Premium – Part 4 of 5

Up until now, our discussion of the discount rate as “one of the most important inputs surrounding the valuation of the business” has focused on overall market data that arrives at the basis of risk associated with the cost of equity for a privately held company. We’ve begun with a risk-free rate and added risk for equity and size. Now, we need to look at the subject company to determine if we should any additional risk for factors not accounted for in the first three inputs. For example, does the business have a strong management team? Is risk impacted by the industry in which it competes? Is there risk in the supply chain in securing the products needed to produce the company’s products? All of this risk is accounted for in the Company-Specific Risk Premium (or CSRP).

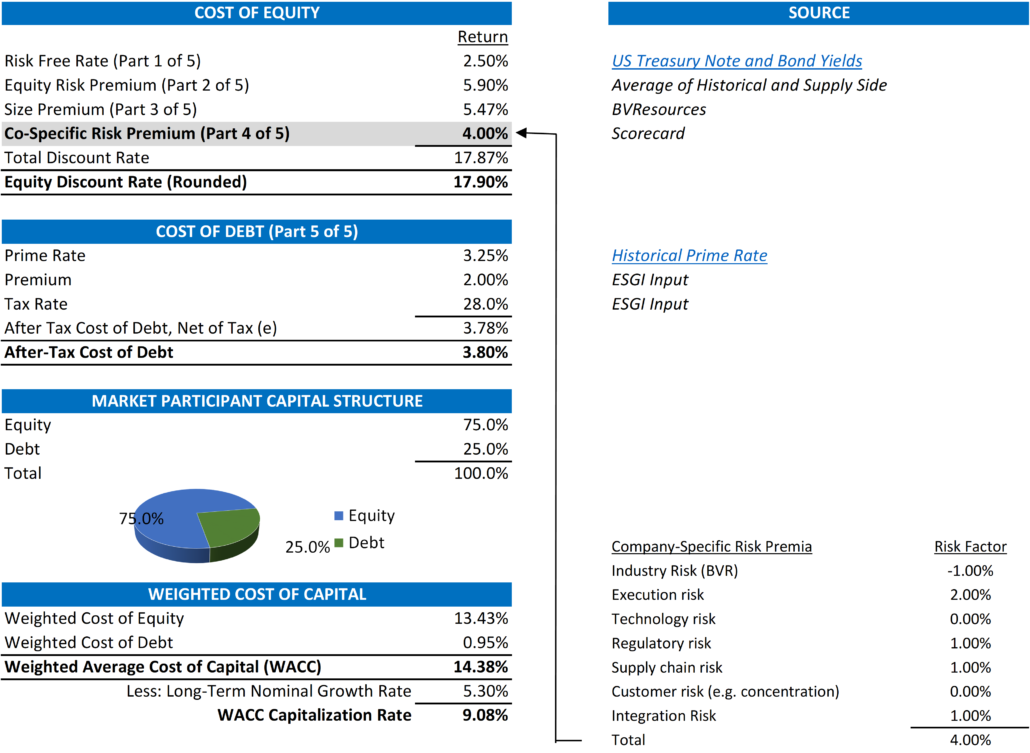

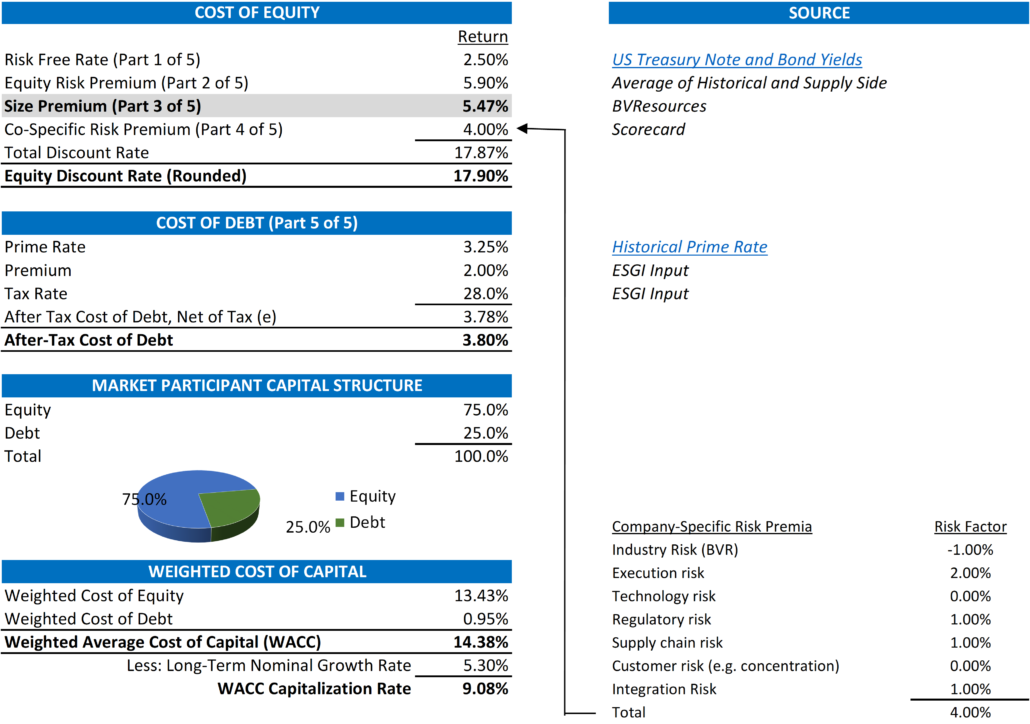

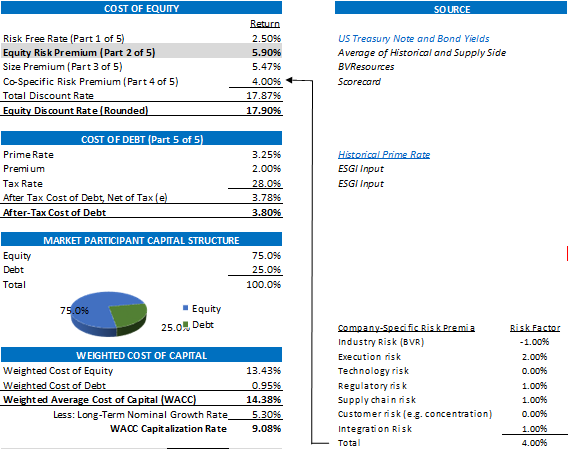

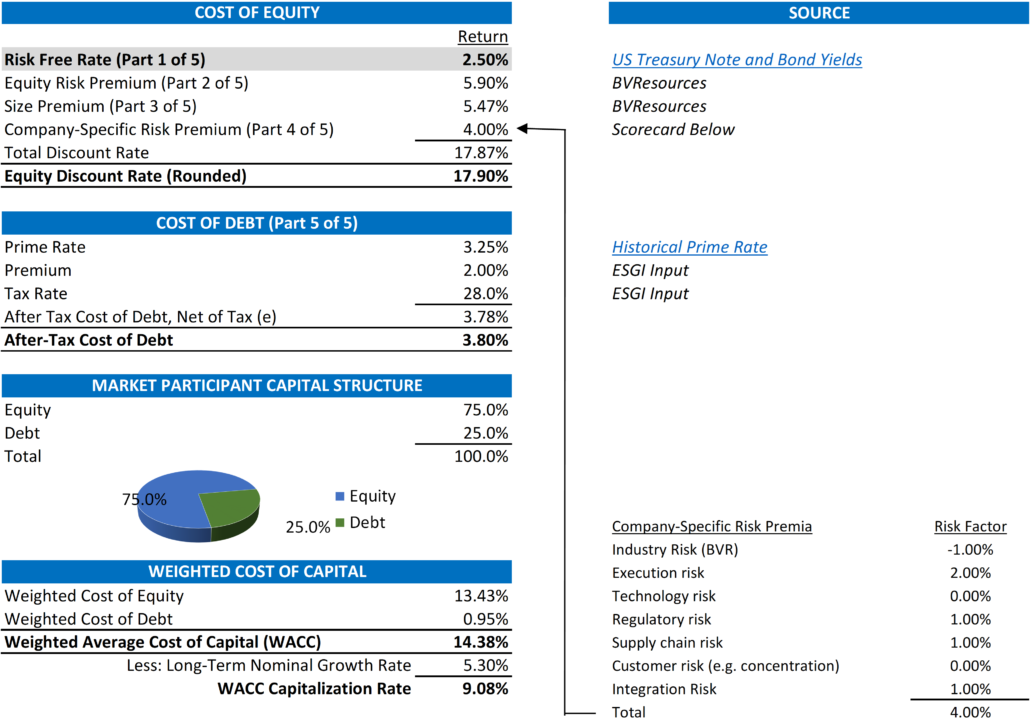

Again, a highlight of how we build up both the cost of equity and the weighted cost of capital is pictured below. As noted, the highlight deals with our discussion of the CSRP which is built out below and to the right of this summary;

Build-Up Approach – Company-Specific Risk Premium

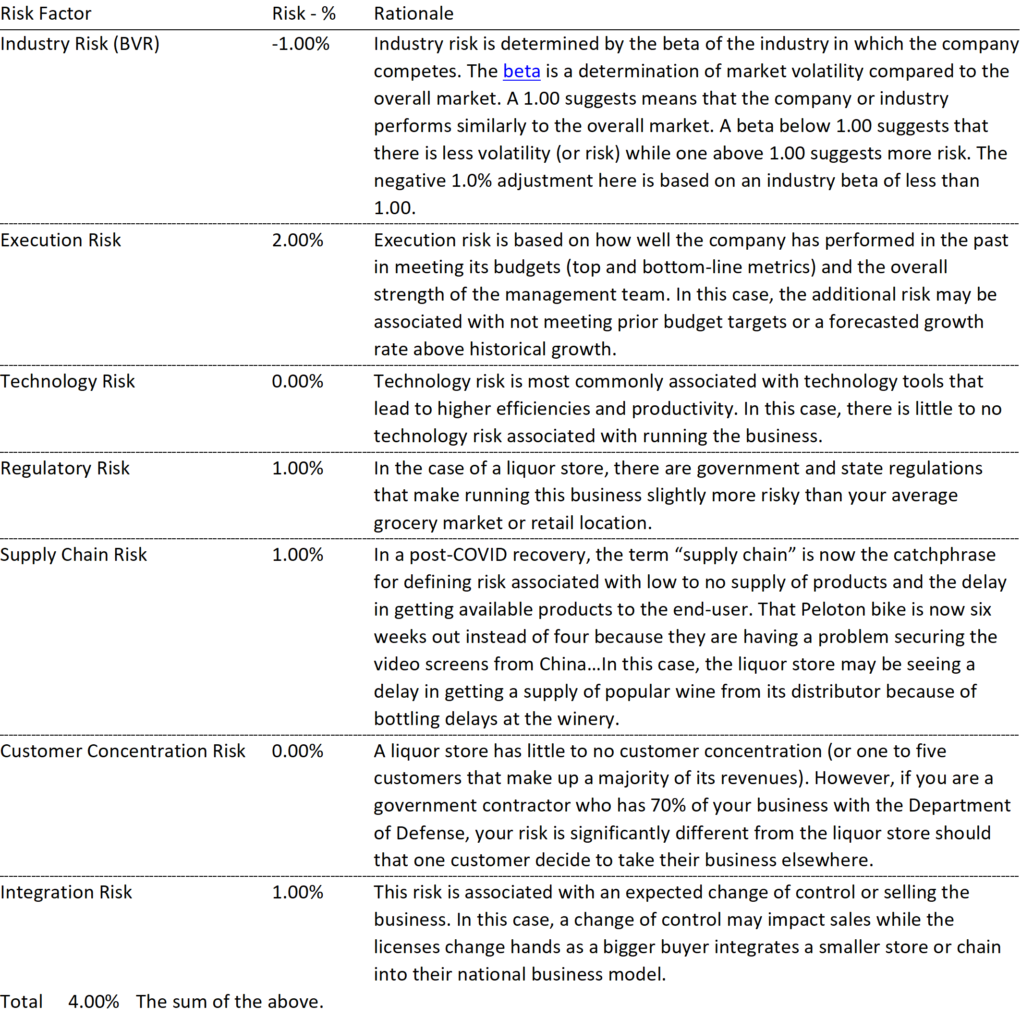

As noted above and highlighted in the matrix that identifies and quantifies this risk, all of these factors relate to the business, how it competes as well in the environment in which the company and its industry compete. To dig into the list above, let’s assume that the subject company is a small chain of liquor stores located in a mid-sized but growing metropolitan area; Sonoma County, CA where Exit Strategies is headquartered.

Below is an enlarged copy of the matrix outlined above. As you can see, it is a list of risk categories that are not related to the overall market (type of security and size) but instead associated with the company’s business model, how it navigates the unique challenges of executing on it, and how it competes with other in its industry. A discussion of the specific rationale for adding (and subtracting) risk to the subject business; a liquor store in Sonoma County.

Fair Market Value is defined as “the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts.” In determining this value using an income approach and discount rate, the above list is what a valuation expert would expect a willing buyer to see as an incremental risk to buying the business.

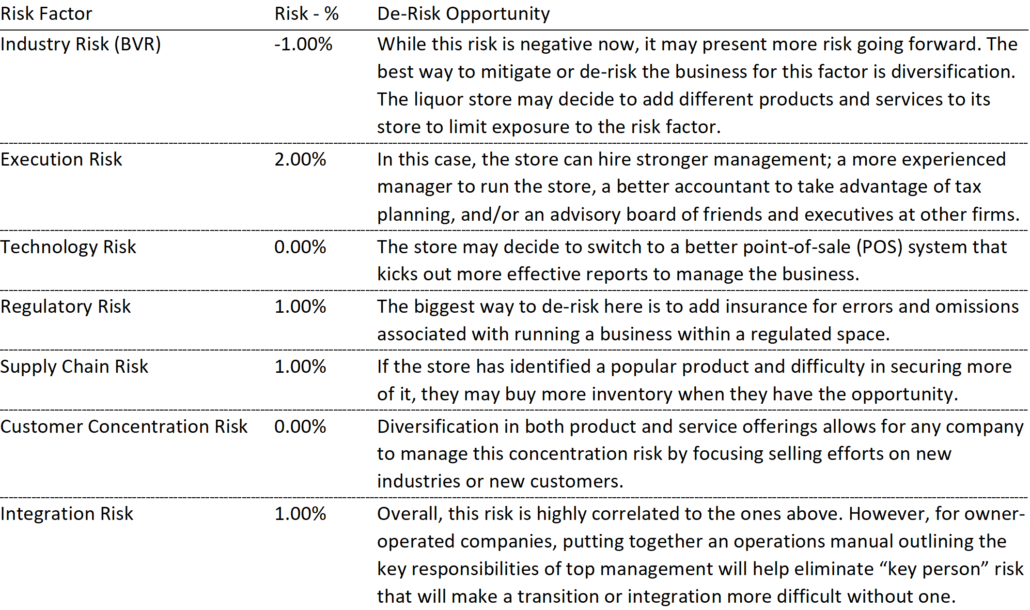

However, a willing buyer (or even a willing seller two years before selling the business) can look at this list as a “to-do” to increase value by “de-risking” the business associated with these specific risks.

What Does This All Mean?

All other key inputs (cash flows and long-term growth) de-risking the business for these company-specific risks will increase the value of the business. Less risk correlates to higher values. However, there may be a tradeoff in de-risking and value with an increased cost structure (insurance, technology tools, increased staff). In this case, the real challenge for management is leveraging these incremental costs by increasing revenue and profits.

Stay tuned for our last installment where we look at the cost of debt and how the ability to secure debt over equity lowers your discount rate and has a positive impact on value.

Exit Strategies values control and minority ownership interests of private businesses for tax, financial reporting, strategic purposes. If you’d like help in this regard or have any related questions, you can reach Joe Orlando, ASA at 503-925-5510 or jorlando@exitstrategiesgroup.com.

Basic Definitions

Basic Definitions

Even if your business is not for sale, monitoring its market value can be incredibly helpful. This article describes six ways that understanding value over the life of a closely held business benefits shareholders, directors and managers.

Even if your business is not for sale, monitoring its market value can be incredibly helpful. This article describes six ways that understanding value over the life of a closely held business benefits shareholders, directors and managers.