Buy-Sell Agreement Valuation Resources

Every business with two or more shareholders should have a buy-sell agreement. A buy-sell agreement is a legally binding contract that restricts and governs how shares are priced and transferred between shareholders or partners of closely-held businesses when certain trigger events occur. Arguably, valuation is the most important (and argued over) aspect of buy-sell transactions.

A good one-third of our business valuation work relates to internal equity transactions, and because this is an area of our practice that we are extremely involved in and passionate about, we’ve authored many articles about buy-sell agreements over the years. This post is a compendium of those articles, for easy reference:

Exit Strategies Group’s Buy-Sell Agreement Valuation Articles

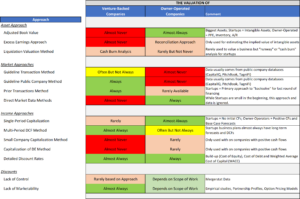

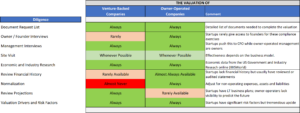

- Choices of Pricing Methodologies in Buy-Sell Agreements

- Pros and Cons of Price Formulas in Buy-Sell Agreements

- Hidden Problems with the Price Formula in Your Buy-Sell Agreement, and Solutions

- How a Covenant not to Compete Affects Value in Buy-Sell Agreements

- Does My Buy-Sell Agreement Establish Value for Estate Purposes?

- Funding Your Buy-Sell Transactions

- Four Questions Your Buy-Sell Agreement Should Answer

- The Dismal D’s of Buy-Sell Agreements (shareholder departure, disinterest, divorce, death, disability, etc.)

- Buy-Sell Agreement Categories (as defined by the relationship between the parties to the agreement, i.e., the individual owners and their business entity.)

- Your Buy-Sell Agreement: In good shape? Needs a tune up? Or disaster waiting to happen?

- Your Buy-Sell Agreement – Keep It Current Before It Costs You Money and Grief!

- One Business Appraiser that All Parties Know and Trust

Finally, a summary of Exit Strategies Group’s services relating to buy-sell agreements.

MCLE Workshop for Attorneys

Our team also developed a free workshop for attorneys titled, “Avoiding Landmines in Buy-Sell Agreements: A Valuation Expert’s Perspective.” This program qualifies for 1.0 hour of MCLE credit and has been attended by over 250 attorneys so far. Contact Joe Orlando for further information.

Exit Strategies Group provides business valuation and consulting services to business owners and attorneys, to help them create, fix and administer buy-sell agreements (BSA’s). Feel free to check out these articles, and don’t hesitate to reach out to one of our senior appraisers with a related question or potential need.

Al Statz is the founder and President of Exit Strategies Group, Inc. For further information on this subject or to discuss an M&A, exit planning or business valuation question or need, Email Al or call him at 707-781-8580.

In the summer of 2019, my son, entering his sophomore year of high school, asked if I would be interested in chaperoning a service trip to Panama for

In the summer of 2019, my son, entering his sophomore year of high school, asked if I would be interested in chaperoning a service trip to Panama for  After a lockdown, a few open windows to travel (that shut as quickly as they opened), and subsequent COVID variants that eliminated any opportunity to make the trip in the spring of 2020 or 2021, plans were cemented (pun intended) and we boarded a plane in Portland, OR on our way to Panama City through Houston on April 1st. For those of you who got my out-of-office response, I was off the grid for 10 days. The opportunity to travel with your child for 10 days without electronics was a gift in itself. Paper made a reappearance in his life; playing cards at the airport, reading books on the plane, and writing in his journal. As a chaperone, I was able to have my phone but as the map shows you, we were about 4 hours west of Panama City and out of range of most cell coverage. After a full day of travel, a night in a youth hostel, and a long bus ride sitting next to chatty teenage girls the next day, we were greeted with the warmest welcome from the Los Pilares community (see the picture above and the t-shirts we made for the trip).

After a lockdown, a few open windows to travel (that shut as quickly as they opened), and subsequent COVID variants that eliminated any opportunity to make the trip in the spring of 2020 or 2021, plans were cemented (pun intended) and we boarded a plane in Portland, OR on our way to Panama City through Houston on April 1st. For those of you who got my out-of-office response, I was off the grid for 10 days. The opportunity to travel with your child for 10 days without electronics was a gift in itself. Paper made a reappearance in his life; playing cards at the airport, reading books on the plane, and writing in his journal. As a chaperone, I was able to have my phone but as the map shows you, we were about 4 hours west of Panama City and out of range of most cell coverage. After a full day of travel, a night in a youth hostel, and a long bus ride sitting next to chatty teenage girls the next day, we were greeted with the warmest welcome from the Los Pilares community (see the picture above and the t-shirts we made for the trip).