Revenue Ruling 59-60 was developed by the Internal Revenue Service to provide guidelines for the valuation of closely held companies. The ruling specifically addresses stock valuations for gift and estate tax purposes, yet the principles set forth are commonly applied in a wide spectrum of business valuations, including those prepared for employee stock ownership plans, charitable contributions, shareholder buy-sell agreements, mergers and acquisition transactions, SBA loans, corporate reorganizations, marital dissolutions and bankruptcies.

Revenue Ruling 59-60 suggests analyzing eight significant factors. They are:

1. Nature of the business and the history of the enterprise from its inception.

A value analyst assesses the basic business model, major milestones, growth, management, diversity of operations, and more, in order to understand the company’s stability, future prospects and risks.

2. Economic outlook in general and the condition of the specific industry in particular.

Economic conditions at the global, national, state and local levels, are considered, as appropriate for the business being valued. The industry in which the company operates is analyzed to understand its maturity, volatility, systematic risks, competitiveness and future prospects, and the company’s position within the industry is studied.

3. Book value of the stock and the financial condition of the business.

Balance sheets for the past 3-5 years are generally reviewed for financial condition and trends. The value analyst looks at liquidity, working capital, investment in fixed assets, long-term indebtedness, capital structure and so forth. When more than one class of stock exists, voting rights, dividend preference, and rights upon liquidation are considered.

4. Earning capacity of the company.

Income statements for the past several years are examined to determine levels and trends in revenues, cost of goods and operating expenses. Accounting irregularities are often ‘normalized’ and nonrecurring and extraordinary income and expense adjustments are made. When valuing a controlling interest in a company, owner compensation and perquisites are adjusted to market rates. The goal is to understand true earnings capacity from the perspective of a willing buyer. When available, management’s financial projections are analyzed as well.

5. Dividend-paying capacity.

The value analyst considers, in addition to the earnings of a company, the amount available to pay in the form of dividends to the owners after allowing for the cash and capital needs of the company. A company’s ability to pay dividends may show no relationship to past dividends paid, since dividend policy is set by controlling shareholders.

6. Whether or not the enterprise has goodwill or other intangible value.

Goodwill generally arises from a going concern company’s intangible assets and is primarily evidenced by a company’s ability to generate earnings. Brand, reputation, patents, trade secrets, institutionalized knowledge, customer relationships and simple longevity in the market may contribute to intangible value. Intangible value is a significant portion of the total value of most operating companies today.

7. Sales of the stock and the size of the block of the stock to be valued.

Previous sales of shares in the company should be reviewed to determine whether they represent prior arms-length transactions. Whether the block of shares being valued is a controlling or non-controlling interest affects value. For many reasons, the values of two different blocks of stock may not be the same.

8. Market price of stocks of corporations engaged in the same or a similar line of business having their stocks actively traded in a free and open market, either on an exchange or over-the-counter.

The price of actively traded stocks of similar companies is primarily used to appraise large closely held companies. It involves identifying small public companies that are in the same industry and using the stock prices of those companies with some other financial metric (earnings, cash flow, book value, etc.) to determine price multiples that can be applied to the company being valued. To use this method properly, a comparable (or guideline) public company must be similar and relevant to be used as a surrogate for the subject company. As industry author Gary Trugman likes to say, “Comparing the local hardware store with Home Depot may involve similar businesses, but let’s face it, where’s the relevance?”

Click here to download IRS Revenue Ruling 59-60 in its entirety.

For business valuation experts, Revenue Ruling 59-60 is akin to the Bible. Okay I exaggerate, but not by much! It is definitely the most-cited reference source in the business valuation reports that we have been asked to review over the years.

Exit Strategies values private companies for business owners before they make important decisions about sales, mergers acquisitions, recapitalizations, buy-sell agreements, equity incentive plans, and more. If you are business owner and would like to learn more or discuss a potential M&A transaction or valuation need, confidentially, give Al Statz a call at 707-781-8580.

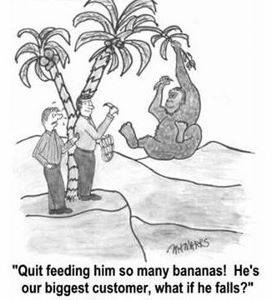

Our seller and business valuation clients are usually proud of their company’s long-term relationships with major clients, and with good reason. Having a high percentage of business with a few customers can be a very profitable and personally satisfying way to run a business. It allows management to focus its attention and fine tune company operations to deliver exceptional service in a very cost-efficient manner. Customer acquisition expenses (marketing, sales, estimating, etc.) can be greatly curtailed or eliminated. It’s wonderful while it lasts.

Our seller and business valuation clients are usually proud of their company’s long-term relationships with major clients, and with good reason. Having a high percentage of business with a few customers can be a very profitable and personally satisfying way to run a business. It allows management to focus its attention and fine tune company operations to deliver exceptional service in a very cost-efficient manner. Customer acquisition expenses (marketing, sales, estimating, etc.) can be greatly curtailed or eliminated. It’s wonderful while it lasts.

A new

A new